5 Questions to Ask Before Taking the Plunge into Homeownership

Homeownership is a big step, but it can be an incredibly rewarding experience if you're ready for it. Before taking the plunge and getting a mortgage loan, there are some important questions you should ask yourself. From your budget to settling down, here are 5 questions to consider before buying a home.

1. Am I Ready to Settle Down?

This is one of the most important questions you need to ask yourself before getting a mortgage. Are you ready to settle down? Buying a house means that you'll be staying in one place for at least five years. So make sure that this is what you want. If you plan on moving soon or would like more flexibility in the future, renting may be a better option.

2. How Much Can I Put Down?

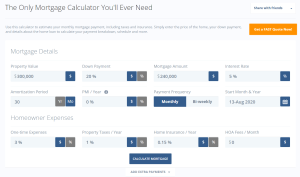

Knowing how much money you have available for your down payment will help determine how much house you can afford. And what kind of mortgage loan best fits your needs. The larger your down payment, the lower your monthly payments will be. Because lenders require borrowers to provide collateral (the house) in exchange for financing. A good benchmark is 20% of the purchase price as a down payment. This enables buyers to avoid paying Private Mortgage Insurance (PMI). Some lenders offer loans with as little as 3-5% down payment if PMI is included in the monthly payment amount.

3. Do I Pre-qualify For A Mortgage Loan?

Once you know how much money you have saved up for a down payment, it's time to start looking at pre-qualifying for mortgage loans. The process of pre-qualifying involves submitting an application along with certain documents such as pay stubs and bank statements that verify your income and assets. This helps lenders determine whether or not they will approve your loan application and gives them an idea of what interest rate they can offer you based on your credit score and financial history. It's important to note that even if you pre-qualify for a loan based on these factors, there could still be other conditions that must be met before final approval is granted by the lender.

4. How Will A Mortgage Affect My Budget?

Securing a mortgage loan also means making changes to your budget so that monthly payments fit comfortably within it without putting undue strain on other areas such as savings or retirement accounts. When budgeting for homeownership, don't forget about taxes and maintenance costs which can add up over time so it’s important to factor those into consideration when creating your budget plan as well! Additionally, having an emergency fund set aside in case something unexpected happens can give peace of mind knowing that there are funds available should anything go wrong with the property or its systems over time (e.g., plumbing issue).

5. Are You Ready To Be Your Own Landlord?

Finally, ask yourself if being a landlord is right for you? While homeownership comes with many perks such as equity growth over time and tax deductions on mortgage interest payments; it also comes with responsibilities such as maintaining all aspects of the property yourself (unless hiring out services) including repairs (e.g leaky pipes) lawn care/landscaping etc., insurance coverage against damages (such as flood insurance), being familiar with local zoning laws & regulations etc.. Being aware of these responsibilities beforehand helps ensure that nothing catches one off guard when becoming an official homeowner!

Bottom Line:

Buying a home requires careful consideration before taking any steps towards securing financing or signing paperwork - from understanding what type of house fits best according to individual needs & wants to making sure all financial obligations associated with homeownership are taken into account prior committing oneself into long term debt; there's no shortage of things one needs do/consider beforehand! By asking oneself these five key questions before taking any further steps towards purchasing a home more informed decisions can be made resulting in more successful outcomes overall! Happy House Hunting!