Understanding Home Equity Lines of Credit (HELOC)

If you’ve been considering taking out a home equity line of credit (HELOC), you’re not alone. In the aftermath of the Great Recession, many American homeowners have turned to their home equity as a source of borrowing power. And with interest rates currently at historic lows, a HELOC can be an attractive option for those looking to consolidate debt, make home improvements, or even finance a child’s education.

But before you sign on the dotted line, it’s important to understand how a HELOC works and what the pros and cons are. In this blog post, we’ll answer some of the most common questions about HELOCs so that you can make an informed decision about whether this type of loan is right for you.

What is a Home Equity Line of Credit?

A home equity line of credit is a type of revolving credit in which your home serves as collateral. This means that if you default on your payments, your lender could foreclose on your home. That’s why it’s important to only borrow what you can afford to repay.

How Much Money Can I Borrow With a HELOC?

The amount of money you can borrow with a HELOC depends on two factors: the value of your home and your loan-to-value ratio (LTV). Your LTV is calculated by dividing your outstanding mortgage balance by your home’s appraised value. Most lenders will allow you to borrow up to 80% LTV, though some may go as high as 85%.

For example, let’s say your home is worth $250,000 and you currently have an outstanding mortgage balance of $150,000. This would give you an LTV of 60%. Based on this LTV, you could potentially borrow up to $100,000 with a HELOC (80% x $250,000).

HELOC vs. Home Equity Loan: What’s the Difference?

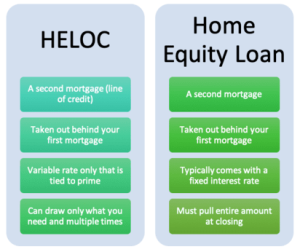

A home equity loan is a type of closed-end second mortgage. This means that when you take out a home equity loan, you receive a lump sum of cash that must be repaid in fixed monthly installments over a set period of time (usually 5-15 years). A HELOC works similarly to a credit card in that it allows you to draw on the funds as needed and only pay interest on the amount that you borrowed. In contrast, with a home equity loan, you borrowed the full amount upfront and begin paying interest immediately on the entire loan balance. Home equity loans also tend to have lower interest rates than HELOCs. However, they may not offer the flexibility that some borrowers need in terms of repayment. Check out the chart below to further compare a HELOC and a Home Equity loan.

Pros and Cons of HELOCS: Is There Such Thing as “Too Much” Home Equity?

Like any financial product, there are both pros and cons to taking out a HELOC. On the plus side, HELOCs offer borrowers flexibility in terms of both how much they borrow and when they make payments (most plans allow for minimum monthly payments or even interest-only payments during periods of low borrowing activity). Additionally, since your home serves as collateral for the loan, lenders are typically willing to extend more favorable interest rates than they would for unsecured loans such as personal loans or credit cards.

On the downside, however, it’s important to remember that your home is on the line if you can’t repay your debt. As such, if real estate values were to drop during this time frame and you found yourself “underwater” on your mortgage (i.e., owing more than what your home is worth), then foreclosure would be a very real possibility. Additionally, while interest rates on HELOCs are often lower than other types of loans/lines of credit. This means that if market rates rise during the draw period.

Bottom Line:

A home equity line of credit can be an excellent way to access cash when you need it - whether it’s for consolidating debt, making home improvements,, or financing another large purchase. However, If after reading this blog post, we encourage you to schedule an appointment with one our Mortgage Advisors so they can help determine whether or not this type of loan is right for you. Click the button below to schedule an appointment with one of your experienced mortgage advisors!