Monday Market Update

Week of February 13, 2023 in Review

News on home price appreciation, mixed auction results, and tough talk from central banks around the world highlighted an otherwise quiet week:

- Does the Future Look Good for Home Prices?

- Central Bank Tough Talk Based on Misunderstanding

- CEOs Feel a Recession Coming

- Jobless Claims Reflect Slower Pace of Hiring

- Important Auctions Bring Mixed Results

Does the Future Look Good for Home Prices?

CoreLogic's Home Price Index showed that home prices nationwide fell by 0.4% from November to December but they were 6.9% higher when compared to December of 2021. This annual appreciation reading declined from 8.6% in November but is still solid. CoreLogic forecasts that home prices will drop 0.2% in January but rise 3% in the year going forward.

What's the bottom line? CoreLogic's Chief Economist Selma Hepp said that while home prices in December "continued to fall from November, the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring's peak." This is a far cry from a housing crash of 20% that some in the media have been predicting.

And while CoreLogic has reported slightly negative readings month to month, they still forecast 3% appreciation nationwide over the next year, which can be meaningful for wealth creation.

In addition, Zillow and Pulsenomics released their Home Price Expectations Survey for the fourth quarter of last year. Survey participants included 117 of the top economists in the country and they were asked about their expectations for home price appreciation over the next five years.

Results showed that respondents' average expected appreciation over the next five years is 23.3% cumulatively. To quantify this, if someone bought a $500,000 home and we saw 23% appreciation over the next five years, they would gain $115,000 in appreciation alone. This data shows there is great opportunity ahead in the housing market, despite the negativity you may hear in the media.

Central Bank Tough Talk Based on Misunderstanding

During an interview last Tuesday at the Economic Club of Washington, DC, Fed Chair Jerome Powell stressed that the Fed would be data dependent as they evaluate how to best fight inflation. Powell noted, "If we continue to get, for example, strong labor market reports or higher inflation reports, it may well be the case that we have to do more and raise rates more than is priced in."

The Fed has hiked its benchmark Fed Funds Rate eight times since last March, bringing it to a range of 4.5% to 4.75%. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. When the Fed hikes the Fed Funds Rate, they are trying to slow the economy and curb inflation.

Powell's remarks followed tough central bank talk from the Bank of England and European Central Bank. Both the BoE and ECB said that the risk of overtightening is dwarfed by the risk of doing too little. They also said that monetary policy needed to continue to show teeth until inflation moves lower to their target.

What's the bottom line? The central bank commentary came on the heels of the much stronger than expected U.S. Jobs Report for January that was reported by the Bureau of Labor Statistics (BLS) on February 3. However, it is based on a misunderstanding of the data.

The BLS' report showed that there were 517,000 jobs created last month, blowing out estimates, but there were large seasonal adjustments, population controls and new benchmarks that greatly impacted the data. On an unadjusted basis, payrolls actually declined by 2.5 million last month.

In addition, the BLS report was in stark contrast to other data that has been released such as ADP's Employment Report, which showed only 106,000 job creations in January. Plus, S&P Global's U.S. Services Purchasing Managers' Index, which is a monthly survey of senior executive at private sector companies, also showed that "hiring has almost ground to a halt as firms reassess their payroll needs in light of the weaker demand environment."

CEOs Feel a Recession Coming

The Conference Board released their Measure of CEO Confidence for the first quarter, which is a survey based on CEOs' perceptions of current and expected business and industry conditions. The responses among the 142 CEOs who participated in the survey during the second half of January showed that CEOs remain cautious about the economy in 2023. Overall, the index came out at 43 and while this is above the 32 seen in the fourth quarter of last year, it is still below 50, which means there were more negative responses than positive.

What's the bottom line? Among the notable statistics, 93% of CEOs reported that they are preparing for a recession in 2023, although most think it will be brief and shallow. In addition, 55% of CEOs believe that a global recession is the greatest challenge for their companies. Regarding their plans for hiring, 37% of CEOs expect to expand their workforce over the next 12 months, which is down from 44% in the fourth quarter. Meanwhile, 48% said they are reducing hiring plans, including selective hiring freezes.

Jobless Claims Reflect Slower Pace of Hiring

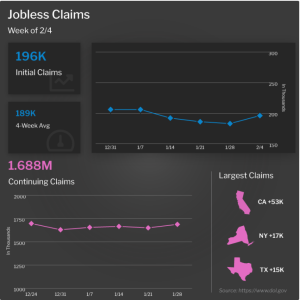

The number of people filing for unemployment benefits for the first time rose by 13,000, as there were 196,000 Initial Jobless Claims reported in the latest week. While this was higher than estimates, it is still low on a historical basis. Continuing Claims, which measure people who continue to receive benefits after their initial claim is filed, rose 38,000 to 1.688 million, the highest amount since the latter part of December.

What's the bottom line? We are continuing to see a tight labor market where companies are doing their best to hold on to workers. However, Continuing Claims have risen by more than 300,000 over the last four months, which also suggests it's becoming harder for many to find a job if they are let go.

Important Auctions Bring Mixed Results

Investors were closely watching Wednesday’s 10-year Treasury Note auction and Thursday's 30-year Bond auction to see the level of demand. High demand, which is reflected in the purchasing of Bonds and Treasuries, can push prices higher and yields or rates lower.

Weak demand, on the other hand, can signal that investors think yields will continue to move higher, which can have a negative effect on rates.

Wednesday's 10-year Note auction was met with very strong demand. It seemed that traders wanted to benefit from the spike in yields which followed the misleading Jobs report, as expected lower inflation data that will be released this week will likely send yields lower. While this strong auction demand boosted Mortgage Bonds Wednesday afternoon, the poor demand at Thursday's 30-year Bond auction added downside pressure to Bonds.

Family Hack of the Week

This Chocolate Mousse courtesy of our friends at The Kitchn is so decadent no one will guess how easy it was to make!

Warm 1/2 cup heavy cream in a microwave safe bowl for 1 minute. Add 1 cup good quality bittersweet chocolate chips and stir to combine. Set aside for 5 minutes so the chocolate melts, then whisk together until smooth.

In a medium bowl, add 1 cup cold heavy cream and beat with an electric hand mixer or with a whisk until soft peaks form. Transfer 1/2 cup to a small bowl and refrigerate to top the finished mousse before serving. Whip the remaining cream until stiff peaks form.

Using a large spatula, fold the whipped cream into the cooled chocolate mixture in three portions. Divide the mixture into 4 ramekins or cocktail glasses. Refrigerate for at least 1 hour and up to 4 before serving.

Dollop with the previously made whipped cream, sprinkle with grated chocolate and toasted hazelnuts, and enjoy!

What to Look for This Week

After last week's quiet economic calendar, this week brings crucial inflation, housing and manufacturing reports.

We'll get an update on inflation when January's Consumer Price Index is reported on Tuesday. Look for the Producer Price Index on Thursday, which will give us news on wholesale inflation.

On Wednesday, the National Association of Home Builders Housing Market Index will provide a near real-time read on builder confidence for this month. Housing Starts and Building Permits for January will be reported on Thursday.

February's manufacturing data for the New York and Philadelphia regions will be released on Wednesday and Thursday, respectively.

Also of note on Tuesday, we'll learn how small business owners were feeling last month via the National Federation of Independent Business Small Business Optimism Index. Retail Sales data for January will be released on Wednesday while the latest Jobless Claims remain important to monitor when that data is released as usual on Thursday.

Technical Picture

Mortgage Bonds ended last week battling support at the 100-day Moving Average. A substantial break lower could lead to Bonds testing the next level of support at 100.094. The 10-year has broken above resistance at its 100-day Moving Average and is currently trading at around 3.75%. There is a lot of room for yields to move higher before the next ceiling all the way up at the 3.908% Fibonacci Level.

Source: https://mbshighway.com